Penalty on Late Payment. Any refund of tax may be offset against other unpaid GST customs and excise duties.

Money Network Money Management Tax Refund Prepaid Card

If your business annual sales do not exceed this amount you are not obliged to register for GST.

. Finance Deputy Minister Mohd Shahar Abdullah gave this assurance at the Dewan Rakyat today. Visit your Customs office in person to follow up. 7 November 2017.

Expedited GST refunds The Ministry of Finance in June 2020 announced that the Royal Malaysian Customs Department is committed to expediting goods and services tax GST refunds with payments expected to be made from 22 June 2020 and targeted to be completed by December 2020. The refund will be paid back to your credit card within 5 days. Here is a step-by-step guideline that can help you to register GST and understand the tax system.

The two reduced SST rates are 6 and 5. He said the Royal Malaysian Customs Department RMCD will employ pay. This is the first case of its kind in Malaysia where the scope of the GST Repeal Act 2018 in relation to input tax refund was examined by the High.

The standard goods and services tax GST in Malaysia is sales and service tax SST of 10. Tourists international passport number. GST refunded upon the completion of risk rating process.

Please note that Malaysias GST has been reduced from 6 to 0 with effect from 1st June 2018. The GST treatment on services of the Approved Refund Agent are to be zero rated supplies which is classified under the GST Zero rated Supplies Order 20XX because it is considered as export services Approved Refund Agent will then recover refunds made under Tourist Refund Scheme from Royal Malaysian Customs Department RMCD. However the Companyclaimant will still subject to Customs audit within 6 years timeframe from 1st September 2018.

He attributed the process delay to invalid bank registrant information and failure of registrants to. Claiming your GST Refund Malaysia is not difficult but you need to know. Many of the above often occur in companies which do not have a designated tax team or structure to manage tax matters or communication from authorities.

The High Court decision is potentially controversial as claiming an ITC. Sunday 28 Jun 2020 1040 AM MYT. Tourists country of residence.

Ketua Pengarah Kastam Anor 17 June 2021 unreported as yet allowed the taxpayer LDMSB a refund of an input tax credit ITC in relation to the former goods and services tax GST as a refund of tax overpaid or erroneously paid. As an initiative to expedite the GST refund process to ease the cash flow burden of businesses the pay first and audit later approach will be adopted. JUNE 28 The recent announcement made by the Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz that the Government will expedite the Goods and Services Tax GST refund to ease the cash flows of businesses during this trying time is applauded.

Amendment to final GST return Malaysias goods and services tax GST was replaced by the sales tax and services tax but there are still transitional GST issues that may need to be resolved. Set out below is a summary of the announcement and the FAQs- For GST refund involving amounts below RM100000 GST will be refunded in full after a verification process desk review by the RMCD Note 1. GST refund will be remitted upon verification process completed.

By way of background the goods and services tax GST regime in Malaysia was implemented on 1 April 2015. Amendment to final GST return due by 31 August 2020 Malaysia. 858 PM MYT.

KUALA LUMPUR Aug 3 The Ministry of Finance will settle the Goods and Services Tax GST refund arrears totalling RM4763 billion by the end of the year. Tax Estimation Advance Payment. ON Jan 2 the Finance Minister wrote an op-ed in the StarBizWeek which amongst other things talked about the government executing its Medium-Term Revenue Strategy.

The Finance Ministry through the Royal Malaysian Customs Department is committed to ensuring that the Goods and Services Tax GST refund to taxpayers will be. The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and accounting business consulting electricity. The IRBM Clients Charter sets that tax refund will be processed.

Minister Tengku Datuk Seri Zafrul Abdul Aziz said the payment process would be completed by December this year. The High Court ruled that customs had erroneously rejected the taxpayers claim for an ITC refund. The taxpayer was awarded the ITC refund with 8 interest running from the date the refund was due.

A recent decision by Malaysias High Court in LDMSB v. Directly follow up with the Customs officer to check on the refund status 1. Seal the validated original refund form in an envelope given to the tourist at the Approved Outlet and post it to the Approved Refund Agent to process the GST refund within 2 months of RMCDs endorsement or drop the refund form in the mail box located near the GST Customs Verification Counter airside before departing from Malaysia by air mode.

Within 90 working days after manual submission. You should still follow the instructions below to claim any GST paid on purchases made until 31st May. GST refund less than RM 100000.

The procedure however is subject to information given in ITRF as well as the submission of supporting. Date of arrival in Malaysia. The Tax Refund Form is valid 2 months from the date of Customs validation.

There are two ways to get your money back. Refund will be made to the claimant within 14 working days if the claim is submitted online or 28 working days if the claim is submitted manually. After this process GST will be fully refunded and.

Get an original GST refund form from the sales assistant cashier at the Approved Outlet and ensure that the refund form is completed correctly. The GST refund form should contain the following particulars. GST Refund Forms sent by.

Under Goods Services Tax GST system in Malaysia businesses with annual sales of RM500 000 or more are required to be registered under the GST. To meet medium-term. Within 30 working days after e-Filing submission.

The GST refund can be paid in cash but only to maximum 300 MYR equivalent to 70 USD. Claiming your GST Refund as you leave Malaysia TRS by Lesley on April 3 2015. GST refund more than RM 100000.

It applies to most goods and services. Prior to the implementation of GST Royal Malaysian Customs Department RMCD collects sales tax from companies on certain imported and locally manufactured goods under the Sales Tax Act 1972 STA. Amendments to the final GST-03 return if any must be made by 31 August 2020.

KUALA LUMPUR June 15 The Finance Ministry through the Royal Malaysian Customs Department is committed to ensuring that the Goods and Services Tax GST refund to taxpayers will be expedited and payment to be made beginning June 22.

Gst Registration Pan India Registration Goods And Service Tax Goods And Services Registration

A Complete Guide On Gst Returns On Exports Refund Process

Guide To Gst Refund In Australia Bragmybag

5 Best Employee Monitoring Tools For Your Business Infographic Good Employee Business Infographic Infographic

Guide To Gst Refund In Australia Bragmybag

Claiming Your Gst Refund As You Leave Malaysia Trs Economy Traveller

Claiming Your Gst Refund As You Leave Malaysia Trs Economy Traveller

The Excise Department In Thailand Plans To Change Its Current Tax Refund Practice By Introducing A Blockchain Based Tax P Commercial Bank Blockchain Tax Refund

Tax Flyer Tax Preparation Tax Refund Tax Consulting

H R Block Hr Block Coding Tax Refund

How To Get Tax Free Shopping In Singapore Living Nomads Travel Tips Guides News Information Singapore Shopping Mall Tax Free Shopping

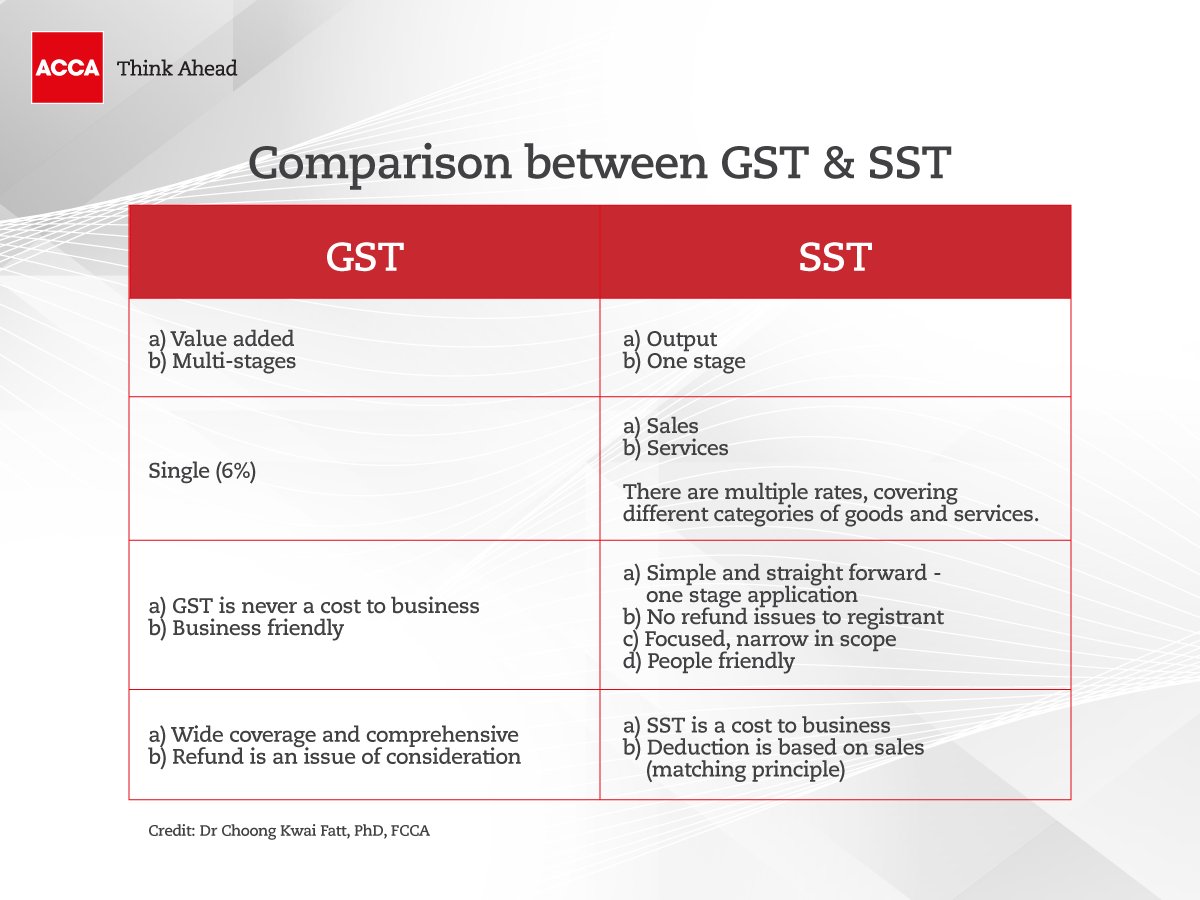

Accamalaysia No Twitter As We Bid Farewell To Gst And Welcome Back Sst It Is Crucial To Understand The Differences Between These Taxes Learn About The Taxes Today And Seize This Opportunity

Gst Guidelines On Tourist Refund Scheme Klia2 Info

Mariels I Will Help You Process An Irs Tax Letter Notices Or Audits For 20 On Fiverr Com Irs Taxes Tax Consulting Business Tax

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Simbolo De Libra Como Economizar Dinheiro Graficos Financeiros

St Partners Plt Chartered Accountants Malaysia What Lhdn Proposing The Tax Credit Contra With Future Tax Instalments Shall We Accept Shall We Insist Lhdn Refund The Tax

Gst Rates In Malaysia Explained Wise